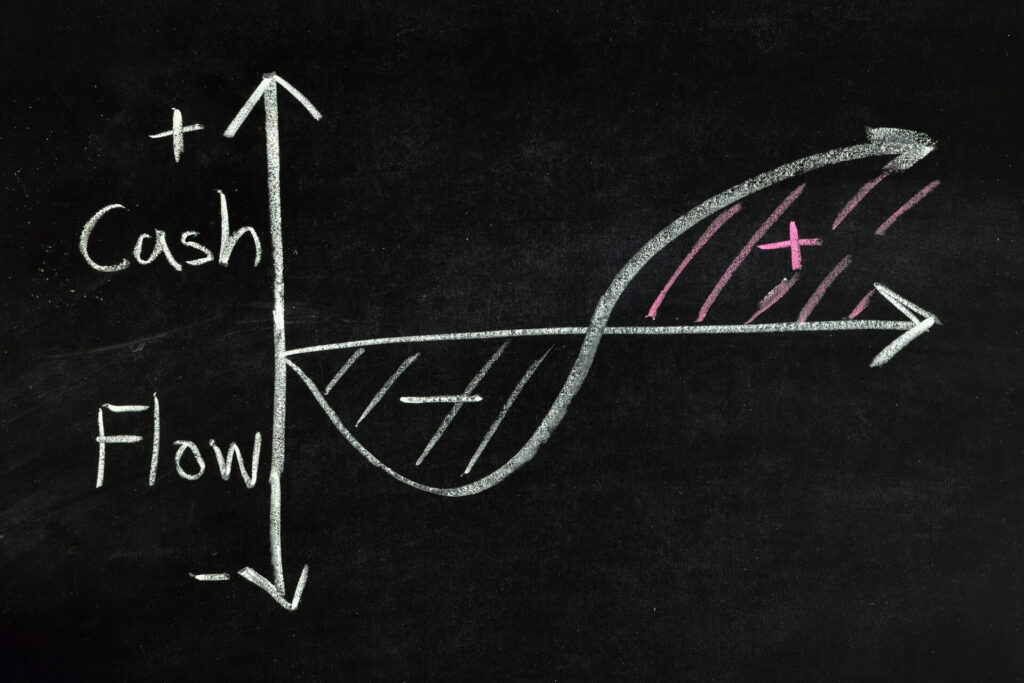

Improving operational efficiency is a powerful strategy for increasing cash flow in your business. By optimizing areas like receivables, inventory, payables, working capital, and operational costs, you can free up cash that was previously tied up in your operations. Below are ways and examples of how enhancing operational efficiency can boost your cash flow.

1. Improve Accounts Receivable Management

A. Faster Invoicing

- Description: Send invoices promptly after delivering goods or services.

- Benefit: Reduces the time it takes to receive payment, improving cash flow.

- Example: A consulting firm implements an automated invoicing system that sends invoices immediately upon project completion, reducing the average collection period from 45 to 30 days.

B. Offer Early Payment Discounts

- Description: Provide customers with a small discount for paying their invoices early.

- Benefit: Encourages quicker payments, accelerating cash inflow.

- Example: A manufacturing company offers a 2% discount if invoices are paid within 10 days instead of the standard 30 days, leading to a significant reduction in outstanding receivables.

C. Implement Strict Credit Policies

- Description: Assess customer creditworthiness before extending credit and set clear payment terms.

- Benefit: Minimizes the risk of late payments or defaults.

- Example: A wholesaler tightens its credit policy by requiring new customers to provide credit references, resulting in fewer bad debts and improved cash flow.

D. Utilize Accounts Receivable Financing

- Description: Sell outstanding invoices to a third party at a discount (factoring).

- Benefit: Provides immediate cash instead of waiting for customer payments.

- Example: A small business sells its invoices to a factoring company, receiving 90% of the invoice value upfront, which helps fund day-to-day operations.

2. Optimize Inventory Management

A. Just-in-Time (JIT) Inventory

- Description: Order inventory only as needed for production or sales.

- Benefit: Reduces holding costs and increases cash flow by freeing up cash tied in inventory.

- Example: An automotive parts manufacturer adopts JIT, reducing inventory levels by 40% and releasing cash previously tied up in excess stock.

B. Reduce Excess Stock

- Description: Analyze inventory to identify slow-moving or obsolete items.

- Benefit: Selling off excess inventory converts idle stock into cash.

- Example: A retail store holds a clearance sale for outdated merchandise, converting stagnant inventory into liquid cash.

C. Implement Inventory Management Systems

- Description: Use software to track inventory levels and automate reordering.

- Benefit: Prevents overstocking and stockouts, optimizing inventory investment.

- Example: A pharmacy installs an inventory management system that alerts when stock levels are low, reducing overstock by 25% and improving cash flow.

3. Extend Accounts Payable Periods

A. Negotiate Longer Payment Terms

- Description: Work with suppliers to extend the time you have to pay invoices.

- Benefit: Retains cash longer, improving cash flow.

- Example: A restaurant negotiates with suppliers to move from 30-day to 60-day payment terms, allowing more time to collect revenue from customers before paying suppliers.

B. Take Advantage of Trade Credit

- Description: Utilize interest-free credit offered by suppliers.

- Benefit: Reduces the need for immediate cash outflows.

- Example: A construction company uses supplier trade credit to finance materials, delaying cash payments and improving liquidity.

C. Manage Payment Schedules

- Description: Schedule payments strategically to optimize cash flow.

- Benefit: Ensures that cash is available for other operational needs.

- Example: A marketing firm schedules vendor payments on the last possible day without incurring penalties, maintaining higher cash balances throughout the month.

4. Efficient Working Capital Management

A. Balance Current Assets and Liabilities

- Description: Monitor and adjust the levels of current assets and liabilities.

- Benefit: Ensures sufficient liquidity to meet short-term obligations.

- Example: A tech startup closely monitors its cash, receivables, and payables to maintain a healthy working capital ratio, increasing cash flow and preventing cash shortages.

B. Improve Cash Conversion Cycle

- Description: Reduce the time between outlay of cash and its recovery.

- Benefit: Accelerates cash inflows and delays cash outflows.

- Example: A retailer decreases its cash conversion cycle by speeding up inventory turnover and extending payment terms with suppliers, leading to improved cash flow.

5. Reduce Operational Costs

A. Streamline Processes

- Description: Identify and eliminate inefficiencies in operations.

- Benefit: Lowers expenses, increasing net cash flow.

- Example: A manufacturing plant adopts lean manufacturing principles, reducing waste and operational costs by 15%.

B. Reduce Energy Consumption

- Description: Implement energy-saving measures to lower utility bills.

- Benefit: Decreases operating expenses.

- Example: An office building installs LED lighting and motion sensors, cutting electricity costs by 20% annually.

C. Outsource Non-Core Activities

- Description: Contract third-party providers for non-essential functions.

- Benefit: Reduces overhead costs and focuses resources on core activities to increase cash flow.

- Example: A small business outsources its IT support, reducing staffing costs and benefiting from expert services without full-time salaries.

D. Implement Technology and Automation

- Description: Use software and automation tools to enhance efficiency.

- Benefit: Lowers labor costs and increases productivity.

- Example: A logistics company implements automation in its warehouse, reducing labor costs by 30% and speeding up order fulfillment.

6. Improve Operational Processes

A. Lean Management

- Description: Adopt lean principles to eliminate waste and improve efficiency.

- Benefit: Enhances productivity and reduces costs.

- Example: A food processing company uses lean methods to streamline production, reducing defects and saving on raw material costs.

B. Employee Training and Engagement

- Description: Invest in employee development to improve performance.

- Benefit: Increases efficiency and reduces errors.

- Example: A customer service center provides training programs, leading to faster call resolutions and higher customer satisfaction, indirectly boosting cash flow through repeat business.

C. Supplier Relationship Management

- Description: Build strong relationships with suppliers for better terms.

- Benefit: May result in discounts, favorable payment terms, or bulk pricing.

- Example: A retailer negotiates volume discounts with suppliers, reducing the cost of goods sold and improving profit margins.

7. Optimize Pricing Strategies

A. Adjust Pricing Models

- Description: Review and modify pricing to reflect market value and costs.

- Benefit: Increases revenue without necessarily increasing sales volume.

- Example: A software company shifts from a one-time purchase model to a subscription model, improving cash flow through regular recurring payments.

B. Offer Bundled Products or Services

- Description: Package products or services together at a discounted rate.

- Benefit: Encourages higher sales volume and increases cash inflows.

- Example: A telecommunications company bundles internet, phone, and TV services, increasing average customer spend.

8. Enhance Revenue Collection Processes

A. Implement Online Payment Options

- Description: Offer customers convenient online payment methods.

- Benefit: Speeds up the payment process, improving cash flow.

- Example: An e-commerce store integrates multiple online payment gateways, reducing cart abandonment and accelerating cash receipts.

B. Regular Follow-ups on Overdue Accounts

- Description: Actively pursue late payments through reminders and follow-ups.

- Benefit: Reduces the amount of outstanding receivables.

- Example: A legal firm sets up automated reminders for clients with overdue invoices, decreasing average days sales outstanding.

9. Review and Reduce Overhead Expenses

A. Renegotiate Contracts and Leases

- Description: Seek better terms for rent, utilities, and service contracts.

- Benefit: Lowers fixed costs, increasing net cash flow.

- Example: A retail store renegotiates its lease agreement, securing a lower monthly rent and saving thousands annually.

B. Implement Cost Controls

- Description: Establish budgets and monitor expenses closely.

- Benefit: Prevents unnecessary spending and identifies areas for savings.

- Example: A nonprofit organization introduces a cost-control program, reducing administrative expenses by 10%.

10. Manage Debt Effectively

A. Refinance High-Interest Debt

- Description: Replace expensive debt with loans at lower interest rates.

- Benefit: Reduces interest payments, freeing up cash.

- Example: A manufacturing company refinances its debt, lowering its interest rate from 8% to 5%, saving substantial cash annually.

B. Schedule Debt Payments Strategically

- Description: Align debt repayment schedules with cash flow patterns.

- Benefit: Avoids cash crunches and maintains liquidity.

- Example: A seasonal business restructures loan payments to coincide with peak revenue periods, easing cash flow management.

Conclusion

Improving operational efficiency is a practical and effective way to increase cash flow in your business. By focusing on areas like receivables, inventory, payables, working capital, and operational costs, you can unlock funds tied up in day-to-day operations. Implementing these strategies not only enhances cash flow but also strengthens your financial position, enabling growth and long-term success.

Our Business Value Builder program is designed to increase the cash flow of your business and increase business valuations by more than 50%. A certified business valuation will determine if your business qualifies for the Business Value Builder program. To schedule a free consultation, click here!